Non-billable expense posting by job number

AUGUST 8, 2022 | EXPENSE CLAIMS POSTING

What is it?

Accountability's Expense Claim Posting capabilities have been expanded. Before this enhancement, posting accounts for expense claims were mapped to Task Types to automate the posting of non-billable expense line items.

We have added a Job No. dimension to automate expense postings to a different GL Account based on the job number assigned.

Why does it matter?

The Job record can be used in lieu of creating additional GL sub-accounts to group expense categories or task types to direct expense postings. This provides agencies with more granular insight, a cleaner chart of accounts, and standardized task types.

How does it work?

Scenario

My agency has 4 GL accounts to capture different types of entertainment expenses

For budgeting purposes, my company wants to accurately record all expenses related to parties and events throughout the year (not just entertainment costs). Instead of creating sub-accounts for these categories, I'll create specific jobs.

For tax purposes and granular reporting, my company wants to track specific entertainment categories. Employees can then use Task Types to record expenses against these categories, e.g. MEA (Meals), GIF (Gifts), ALC (Alcoholic Beverage), etc.

Set-up: Posting to GL Accounts

To ensure that expenses are posted correctly, you can set up a Posting to GL Account for every expense claim posting logic.

Using the scenario above, I have created the mappings below. You'll notice the new Job No. dimension on the page.

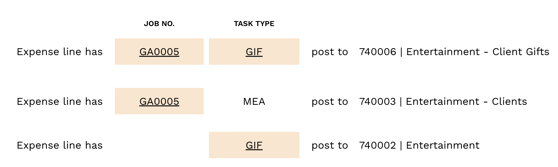

Each task type or a combination of task type and job is mapped to a specific GL account for automated posting. You'll see that the last record maps Job No. GA0005 and Task Type GIF to GL account 740006 (Entertainment - Client Gifts)

I also have an Expense Claim posting record just for Job GA0005 to map to GL account 740003 (Entertainment - Clients).

I could also have an Expense Claim posting record just for Task Type GIF to map to GL account 740002 (Entertainment)

Expense claim posting logic

At a minimum, non-billable expense line items require a task type to be submitted. With this new enhancement, you can direct the GL posting to go to a specific account based on the job number.

Based on this logic and the expense posting records I created, the system will post expenses as follows:

Supplier invoice and PO coding

Supplier invoices and purchase orders will also use the Expense posting record to automatically assign the GL account code for non-billable transactions. This ensures that all costs are posted based on the agency-defined mappings.

Billable expense claims

Billable expense line items coded to a client's job will post to WIP as usual.