[FAQ] How the system calculates Reducing Balance - Yearly Basis Depreciation on Fixed Assets

When using Reducing Balance -Yearly Method, depreciation is charged at a fixed percentage on the book value of the asset. The book value reduces every year by the previous years depreciation amount.

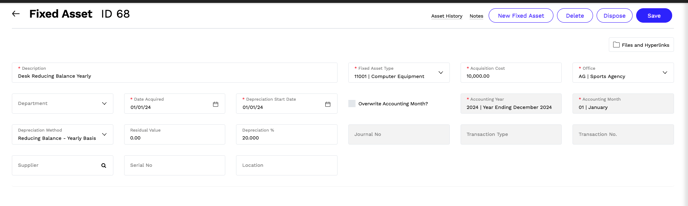

When a fixed asset uses the Reducing Balance -Yearly depreciation method, a depreciation percentage is specified. This percentage, along with the acquisition cost and residual value, is used to determine the total yearly depreciation.

Example: Take a $10,000 asset with a 20% diminishing value depreciation rate. You could claim a $2,000 deduction in your first year (i.e. $10,000 x 20%), a $1,600 deduction in your second year (i.e. ($10,000 – $2,000) x 20%) and so on.

The formula for reducing balance yearly depreciation is:

Yearly Depreciation = (Book Value – Residual Value) * Rate of Depreciation

Applying the values:

1st Year Yearly Depreciation = (10000) × 0.20 = 2000

2nd Year Yearly Depreciation = (10000 − 2000) × 0.20 = 1600

3rd Year Yearly Depreciation = (10000 − 3600) × 0.20 = 1280

and so on until fully depreciated.

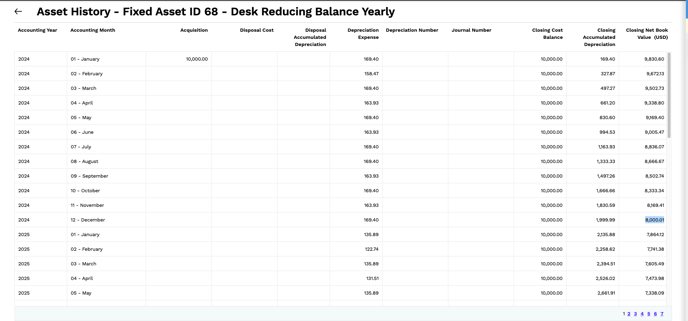

To calculate the monthly depreciation, divide the yearly depreciation by the number of days in the year, and then multiply by the number of days in each month. Since 2024 is a leap year (366 days):

-

For January (31 days):

Monthly Depreciation = (2000 / 366) × 31 ≈ 169.40 -

For February (30 days):

Monthly Depreciation = (2000 / 366) × 30 ≈ 163.93 -

For March (31 days):

Monthly Depreciation = (2000 / 366) × 31 ≈ 169.40

For 2025, which is a non-leap year (365 days):

-

For months with 31 days:

Monthly Depreciation =(1600 / 365) × 31 ≈ 135.89 -

For months with 30 days:

Monthly Depreciation = (2000 / 365) x 30 ≈ 131.51 - For February:

Monthly Depreciation = (2000 / 365) x 28 ≈ 122.74

Note - By default, the Depreciation Percentage is automatically populated from the Fixed Asset Type record. It can be overridden for each individual fixed asset.