How to create a Client

Steps:

- Select Master Files > Clients.

- Select NEW CLIENT.

- Enter Client information - (fields with a red asterisk * are required).

- The client information is broken down in the following categories

- Details

- Location & Tax Settings

- Billing Settings

- Payment Terms

- Other

- Note

- The client information is broken down in the following categories

- Click Save

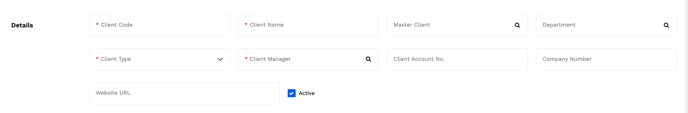

Details

|

Field |

Description |

|

Client Code |

Alpha or numeric can be used. To minimize the length of the Job No., limit the code to 3-5 characters. |

|

Client Name |

This will be the name that appears on Client outputs such as Estimates and Invoices. |

|

Client Manager |

Assign the Employee who is responsible for the overall financial management of the client. Tip: Several reports in Accountability allow users to select and filter according to the client manager. The client manager can be changed at any time, however, changing the client manager here will not re-assign the client manager assigned to existing jobs. |

|

Master Client |

Where multiple individual clients have been created to segregate activity for various divisions of an umbrella Master Client and can be assigned as belonging to that master client. This is essentially an optional grouping used for the following:

TIP: Receivables Aging reports can be optionally grouped or filtered by master client |

|

Client Type |

Optional posting structures can be created based on client type, such as maintaining separate General Ledger AR control accounts for client types. Several reports in Accountability allow users to select and filter according to the client type. New client types can be created by going to MASTER FILES > Clients > Client Types > CREATE A NEW CLIENT TYPE. |

|

Department |

Optional, Default department for the client |

|

Client Account Manager |

Appears in the header section of invoices |

|

Company Number |

Appears in the header section of invoices and on Tax Reports for invoices assigned to the client. Usually, this is the official government tax registration number applicable to the client. |

| Website URL |

Clients website information |

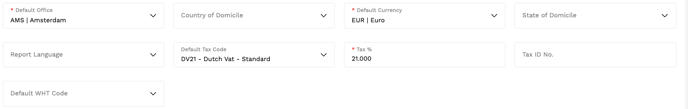

Location and Tax Settings

| Field | Description |

| Default Office | Assign the Office that is, by default, responsible for the financial management of the client. It is the office that the job is assigned to, which drives which Office GL that accounting entries for revenue and receivables will be posted. The office can be changed at any time. However, changing the office here will not re-assign the office assigned to existing jobs. |

| Country of Domicile | Select a country to appear on the Tax Accrual Basis report |

| Default Currency |

The default currency is applicable to estimates and invoices. When an estimate or an invoice is added for the client, the currency will be applied by default. This may be varied for individual estimates and invoices as required. New Currencies can be created by going to SET UP FILES > Currencies > CREATE A NEW CURRENCY. |

| State of Domicile |

Select a state for this client.

|

| Report Language | Only assign this where estimates and invoices are to be presented in a language other than the default language defined for the user’s company. |

| Default Tax Code | Will default to the Office’s default Tax Code but can be overridden and also be changed when creating a financial record. |

| Tax % | Driven by the Tax Code. It can be overridden and also changed, creating a financial record. |

| Tax ID No. | Appears on the Client Invoice |

| Default WHT Code |

The default withholding tax structure is applicable to invoices. When an invoice is added for the client, this code will be applied by default, but this may be varied for individual invoices as required. New WHT Codes can be created by going to SET UP FILES > Withholding Tax Codes > CREATE A NEW WITHHOLDING TAX CODE. |

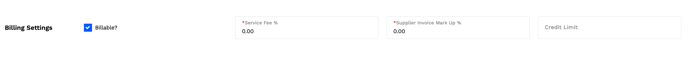

Billing Settings

| Field | Description |

| Billable |

Defines whether jobs for this client are for billable or non-billable activity by default but can be changed at the job level. In most cases, A 'non-billable' client will be created to track internal activities, such as the recording of internal time and expenses. |

| Service Fee% |

Optional percentage-based fee added to estimates and production invoices. When a new job is added for the client, the job service fee % will default to the % assigned here, but it can be changed at the job level. Furthermore, this may be varied for individual estimates and invoices as required. Note: Service fees are disclosed as a separate line on estimates and production invoices. |

| Supplier Invoice Mark Up % | An optional percentage-based fee is added to third-party (supplier) cost charges on estimates and production invoices. When a new job is added for the client, the job markup % will default to the % originally assigned but can be changed at the job level. Furthermore, this may be varied for individual estimates and invoices as required. Mark Up is not disclosed on estimates and production invoices. |

| Credit Limit | Appears on Receivables Aging Reports |

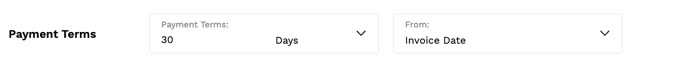

Payment Terms

| Field | Description |

| Payment Terms | Used to calculate the default Due Date on invoices created for the client. These terms appear in the header section of invoices. |

| From |

The basis upon which payment terms will apply. Options are:

|