What's New - September 9, 2024

Search for GL transactions based on creation date

Filter employees based on creation date or creator

Streamline prepayment disposals and adjustments

Accrued revenue reversal enhancement

Search for GL transactions based on creation date

The General Ledger Transactions Search page now includes a Date Added filter. This makes it easier to find posted transactions created on a specific date or date range.

In addition to the filter, you can also update your column Layout with the Added Date. Click on the Layout icon and click the Column Visibility icon next to the Added Date column. Pick the location of the column and add a Data Sort Order so you can easily sort transactions based on their creation date.

Filter Employee list based on creation date and/or creator

The Search Employees page now includes an Added By and an Added Date filter. This makes it easier for a user to filter the list of employees they created today and send a bulk invitation to access the Accountability platform.

Create prepayment adjustments and disposals

The Prepayment Search and Adjustment page provides a centralized view of all prepayment records without running the Prepayments Reconciliation report and supports the following prepayment adjustment scenarios:

Create a Prepayment schedule outside the source invoice or journal

This expanded functionality supports the following scenarios:

- The accounting month that a supplier invoice was posted to is closed, preventing the creation of a prepayment amortization schedule from the source invoice.

- The prepayment adjustment does not have a corresponding supplier invoice or journal, i.e. you want to simply record a prepayment and amortize that amount.

Dispose of an existing prepayment

Let's say you have created a prepayment in month 05/2023 amortized across 24 months from 06/2023 to 06/2025. However, part of the way, you might want to dispose of the remaining prepayment balance for 08/2024. This expanded functionality will:

- Create a "disposal" of the prepayment record in 08/2024: Credit prepayments GL expense account, debit prepayments GL control account for the remaining net balance of that prepayment as at the start of the month 08/2024.

- Remove the future prepayment amortization records and journal postings in the months from 08/2024 through 06/2025.

See the Prepayments Search and Adjustment knowledgebase article to learn more.

Streamline Accrued Revenue reversals

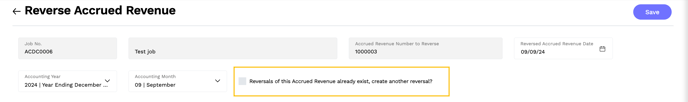

This update enhances the management of accrued and deferred revenue reversals by incorporating validation checks to promote more deliberate reversal actions and allowing multiple reversals simultaneously for improved user efficiency.

You now have more control over the creation of additional accrued revenue reversals. If a reversal already exists for an Accrued Revenue transaction, the Save button is disabled unless you check the option "Reversals of this Accrued Revenue already exist, create another reversal?"

In addition to this added control, you also now have the option to reverse multiple Accrued Revenue transactions. Select the transactions and click the Reverse button.

Manage FX movements for accrued and deferred revenue

You can now create FX Revaluations for Accrued and Deferred Revenue transactions. This is useful when creating revenue accrual and deferral journals at month-end and there's are FX differences for jobs where the transactions currency is different than the Office Currency.

Navigate to Accounting>General Ledger>FX Revaluations. You can revaluate your accrued and deferred revenue balance using one of the FX rates sources on the screenshot below. The system will use the Revaluation FX rate to calculate the Revaluation Amount to post to your FX Gain/Loss account and the corresponding Accrued or Deferred Revenue account.

The Aged Accrued and Deferred Revenue Reports have also been updated with an option to Include FX Revaluations. If selected, the Revaluation Amount is included in the total of any foreign currency transaction.

Additional validation: Accrued and Deferred revenue transactions with FX Revaluations cannot be unposted.

Enable Two-Factor Authentication (2FA)

Agencies who are not on Single Sign-On (SSO) can now enable Two-Factor Authentication for an additional layer of security. Agency Administrators can enable 2FA by navigating to Set Up Files>Set Up Options. Under Other Options, check the option Use two-factor authentication.

We advise communicating this change and share the knowledgebase article below to your employees prior to enabling this option.

https://knowledgebase.counta.com/knowledge/two-factor-authentication

2FA will be mandatory for all agencies on November 30, 2024.